It’s no secret that, at least in the United States, labor markets have tightened. In this article, we will review the reasons automation is coming to the fore, examine the five factors that are hindering investment, and lay out strategies that can position contract logistics companies to prepare for an uncertain future.Īt first blush, more automation seems like the answer to three problems facing contract logistics companies. In the first, we examined the implications of autonomous trucks.

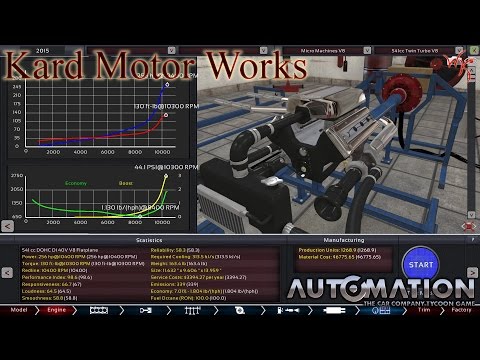

#Automation game tech value series

This is the second in a series of five articles on disruption in transport and logistics. We see five reasons companies are hesitating: the unusual competitive dynamics of e-commerce, a lack of clarity about which technologies will triumph, problems obtaining the new gizmos, uncertainties arising from shippers’ new omnichannel-distribution schemes, and an asymmetry between the length of contracts with shippers and the much-longer lifetimes of automation equipment and distribution centers. For every force pushing companies to automate, countervailing factors suggest they should go slowly. Yet for all the excitement, most logistics companies have not yet taken the plunge.

For example, trains traveling heavily populated routes or hauling hazardous materials will likely continue to need human oversight. Over time, railroads will continue to search for opportunities to automate the main line, but some limits will persist for the foreseeable future. Several European and US railroads have PTC schemes in the works, and a few have fully implemented them. Positive train control (PTC) is a long-desired step toward an automated future: its data links allow for real-time automated control of sets of trains. While the physics of trains makes automation on the main line a longer-term prospect, rail operators and governments are investing in technologies that lay the foundation. Autonomous cranes are also likely to emerge in the near term. Intermodal terminals will likely see increased use of autonomous hostlers to move containers to and from trains. In rail, automation will likely begin in terminals, which offer controlled environments and repeatable processes. Please email us at: the remaining transport modes, automation in ocean and air freight is quite possible but will probably not move the productivity needle much. If you would like information about this content we will be happy to work with you. We strive to provide individuals with disabilities equal access to our website. See sidebar “Automating freight flows: Changes for every sector”.) (Automation is also on the table at other transport companies, such as trucking companies and port operators. Contract logistics and parcel companies (which, for sake of convenience, we will call simply “logistics companies”) particularly stand to benefit. Michael Chui, James Manyika, and Mehdi Miremadi, “ Where machines could replace humans-and where they can’t (yet),” McKinsey Quarterly, July 2016. Put it all together, and McKinsey Global Institute estimates that the transportation-and-warehousing industry has the third-highest automation potential of any sector 1 Many trends are thrusting automation toward the top of the logistics CEO’s agenda, not least these three: a growing shortage of labor, an explosion in demand from online retailers, and some intriguing technical advances. So today’s fevered interest in new machinery, after a lull of several years, has plenty of precedent. The history of logistics is also a history of automation, from the steam engine to the forklift to today’s robotic pickers and packers.

0 kommentar(er)

0 kommentar(er)